New York City Income Tax Residency Requirements

Find, Read, And Discover New York City Income Tax Residency Requirements, Such Us:

- New York Tax Forms 2019 Printable State Ny Form It 201 And Ny Form It 201 Instructions New York City Income Tax Residency Requirements,

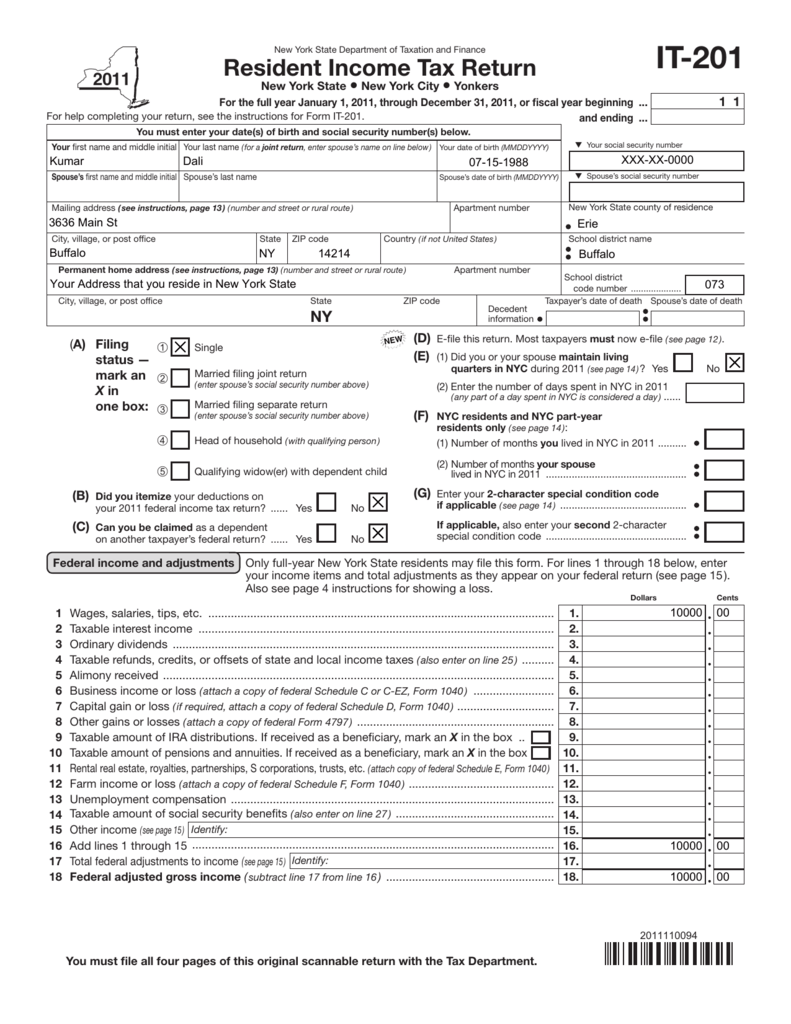

- It 201 New York State Department Of Taxation And Finance New York City Income Tax Residency Requirements,

- 2 New York City Income Tax Residency Requirements,

- 1 New York City Income Tax Residency Requirements,

- Download Instructions For Form Nyc 208 Claim For New York City Enhanced Real Property Tax Credit For Homeowners And Renters Pdf 2019 Templateroller New York City Income Tax Residency Requirements,

New York City Income Tax Residency Requirements, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

You did not have to file a federal return but your federal adjusted gross income plus new york additions was more than 4000 3100 if you are single and can be claimed as.

C street virginia city nevada. For many years your client has lived on long island and worked in the city with an apartment in the city to have available if he should have to stay late one day or he and his wife want to go to a broadway show. If you are a new york state resident you must file form it 201 resident income tax return if you meet any of the following conditions. Your domicile is new york state see exception below.

New york state residents earning wages even when earned outside of the state. New york state and new york citys residency and domicile tests mirror one another. This is in accordance with the us.

If an out of state employer agrees to withhold new york state new york city or yonkers income taxes for the convenience of the employee then the employer is subject to new york state withholding requirements. As a nonresident you only pay tax on new york source income which includes earnings from work performed in new york state and income from real property located in the state. You have to file a federal return.

It seems that new york city believes that your client should be taxed as a city resident. As the state and city scramble to deal with this unprecedented. As of the writing of this alert new york city is unfortunately the epicenter of the covid 19 outbreak in the united states.

As the state and city scramble to deal with this unprecedented pandemic state and local taxes may be the furthest thing from the minds of those who typically spend significant time in the empire state. Non residents on the other hand can only be taxed on income that is derived from or associated with new york sources. New york is a domicile state and as such has two separate residence tests one for a new york domiciled individual and one for a new york non domiciled individual.

Constitution which prevents a state from taxing a non. Or you maintain a permanent place of abode in new york state for substantially all of the taxable year and spend 184 days or more in new york state during the taxable year whether or not you are domiciled in new york state for. As a resident you pay state tax and city tax if a new york city or yonkers resident on all your income no matter where it is earned.

As of the writing of this alert new york city is unfortunately the epicenter of the covid 19 outbreak in the united states. You can take a refundable credit of 125 if youre married and filing a joint return and you have income of 250000 or less. The distinction between new york residency and non residency is important since ny residents are taxed on their worldwide income.

Who you must withhold tax for.

More From C Street Virginia City Nevada

- Jersey City Train Station Nj Transit

- Jersey City Florists 07305

- New York City Japanese Street Food

- 20 2nd Street Jersey City For Sale

- New York City Quality Of Life

Incoming Search Terms:

- New York City Dead Pshaw Says This Lifelong Resident I For One Will Not Forsake My City We Roll Up Our Sleeves And Help Marketwatch New York City Quality Of Life,

- 2 New York City Quality Of Life,

- An Overview Of Taxes In New York City New York City Quality Of Life,

- Ny Tax Department Says Letters Demanding Payment Are A Scam Local News Auburnpub Com New York City Quality Of Life,

- Form It 260 Download Fillable Pdf Or Fill Online New York State And New York City Surety Bond Form Change Of Resident Status Special Accruals New York Templateroller New York City Quality Of Life,

- Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf New York City Quality Of Life,