New York City Income Tax Return

Find, Read, And Discover New York City Income Tax Return, Such Us:

- Nyc 1127 Form For Nonresident Employees Of The City Of New York Hired New York City Income Tax Return,

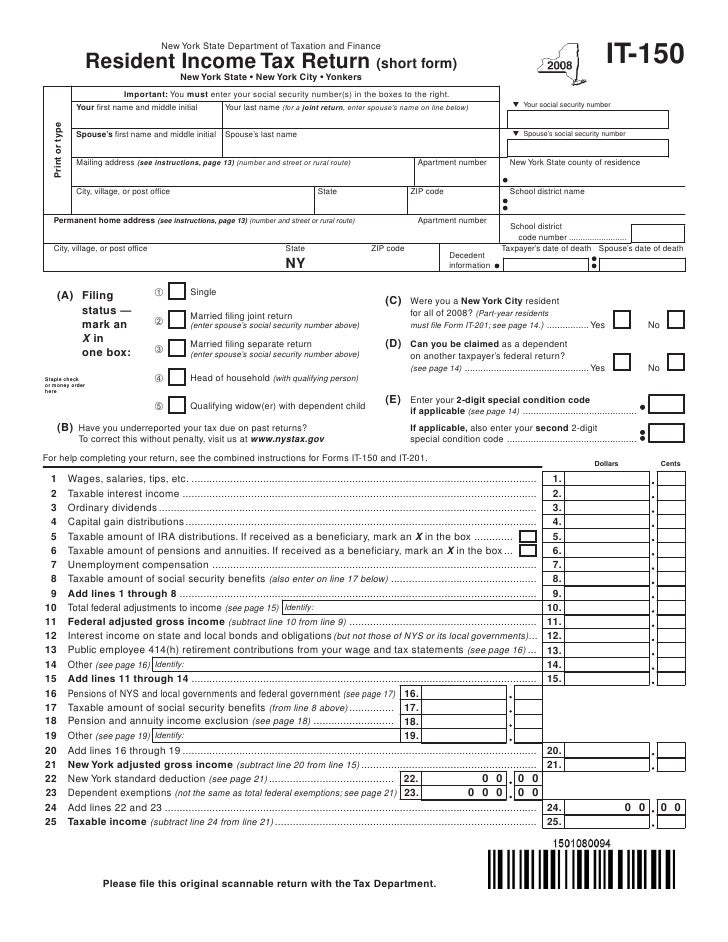

- Form It 201 X 2010 Fill In Amended Resident Income Tax Return Long Form New York City Income Tax Return,

- New York Formally Extends Tax Deadlines New York City Offers Penalty Relief Ksm Blog Katz Sapper Miller Cpa New York City Income Tax Return,

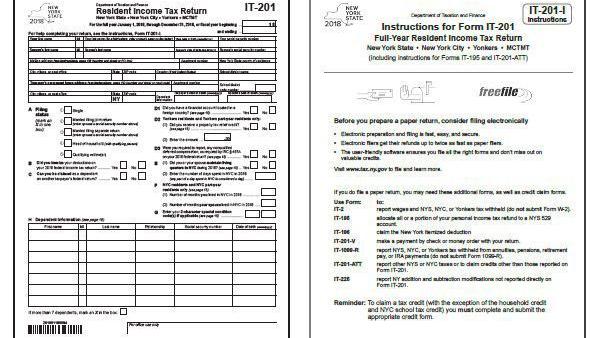

- It 201 New York State Department Of Taxation And Finance New York City Income Tax Return,

- Tax Preparation New York City David Beck Cpa New York City Income Tax Return,

New York City Income Tax Return, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

New york city income tax.

Jersey city heights zip code. Nyc 399 schedule of new york city depreciation adjustments. In new york city that means a sales tax of 45 percent plus a metropolitan commuter transportation district surcharge of 0375 percent for a total sales tax of 8875 percent. Some of the forms and instructions on this web site do not reflect recent changes in tax department services and contact information.

The new york city school tax credit is available to new york city residents or part year residents who cant be claimed as a dependent on another taxpayers federal income tax return. If your business is involved in new york city you may be required to file a new york city tax return. The city income tax rates vary from year to year.

Other states tax forms. If you are not a yonkers. Other states tax forms.

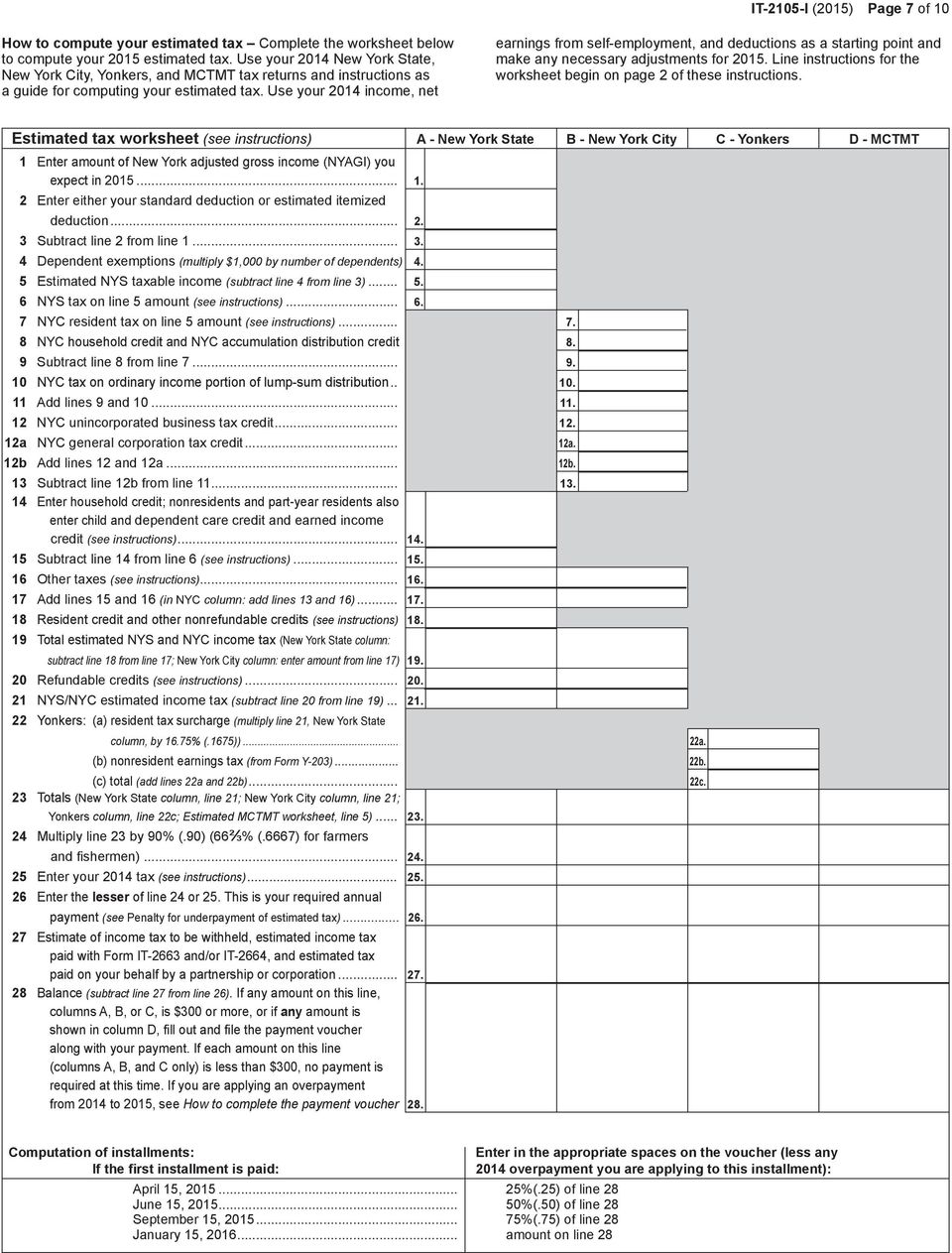

Weve outlined the basics below. The tax rate youll pay depends on your income level and filing status and its based on your new york state taxable income. New york city residents must pay a personal income tax which is administered and collected by the new york state department of taxation and finance.

Corporations and s corporations doing business employing capital owning or leasing property in a corporate or organized capacity or maintaining an office in new york city must file a. New york city forms. Were a new york city or yonkers resident for the tax year and.

Nyc 400 for 2020 estimated tax by business corporations and subchapter s general corporations file online with e services. Have to file a new york state return. Nassau countys sales tax is 863 percent and westchesters is 838 percent.

New york city or yonkers part year residents. New york city forms. You can take a refundable credit of 125 if youre married and filing a joint return and you have income of 250000 or less.

Individuals with yonkers income. The states sales tax is 4 percent but they also have to factor in their local tax. Nyc 579 cor signature authorization for e filed business corporation tax return.

Commonly used income tax forms and instructions. Dof also assesses the value of all new york city properties collects property taxes and other property related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property related charges through annual lien sales. The department of finance dof administers business income and excise taxes.

Nonresident group and. Other personal income tax forms. If you changed your new york city or yonkers resident status during the year complete form it 3601 change of city resident status.

New york city has a separate city income tax that residents must pay in addition to the state income tax.

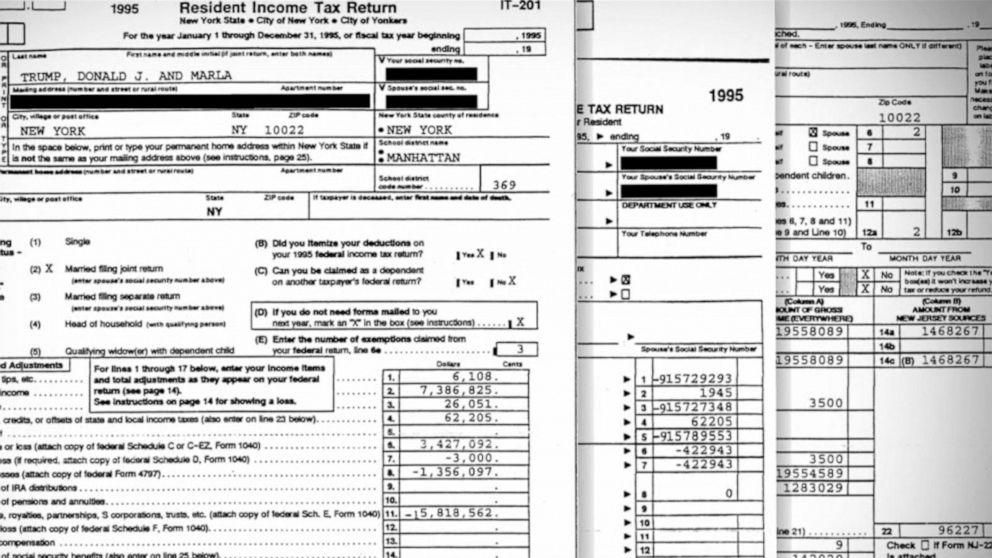

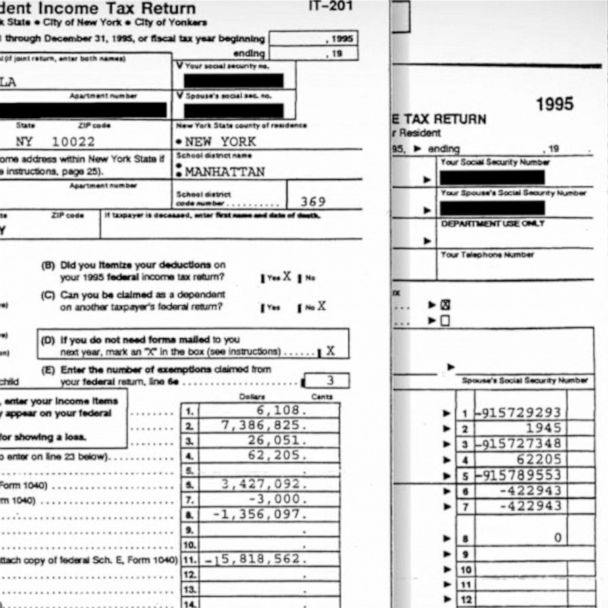

Trump S Attempt To Shield Tax Returns Goes To The Supreme Court Abc News Jersey City Heights Zip Code

More From Jersey City Heights Zip Code

- Jersey City Ori Number

- New York City Income Tax Rate 2019

- New York City Directions From Here

- Tree Lined City Street

- New York City Of Technology

Incoming Search Terms:

- 44 Percent Of High Earners Have Considered Leaving New York City Poll Thehill New York City Of Technology,

- Trump May Have Paid No Taxes For 18 Years New York City Of Technology,

- Download Instructions For Form Nyc 208 Claim For New York City Enhanced Real Property Tax Credit For Homeowners And Renters Pdf 2019 Templateroller New York City Of Technology,

- Trump S Attempt To Shield Tax Returns Goes To The Supreme Court Abc News New York City Of Technology,

- Make A Personal Income Tax Return Payment Online New York City Of Technology,

- New York State Taxes Tax Rates A Guide To Ny State Taxation New York City Of Technology,