New York City Tax Rate

Find, Read, And Discover New York City Tax Rate, Such Us:

- If You Live In New York And You Rent You Re Paying A Huge Tax You Don T Even Know About Business Insider New York City Tax Rate,

- Nyc Does New York City Tax Scale Similar To Federal Taxes Personal Finance Money Stack Exchange New York City Tax Rate,

- New York City 2016 Real Property Tax Rates Nyc Blog Estate New York City Tax Rate,

- Property Taxes In New York City Skyrocket Wsj New York City Tax Rate,

- Do You Know What You Pay Every Day In Taxes The Fiscal Times New York City Tax Rate,

New York City Tax Rate, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

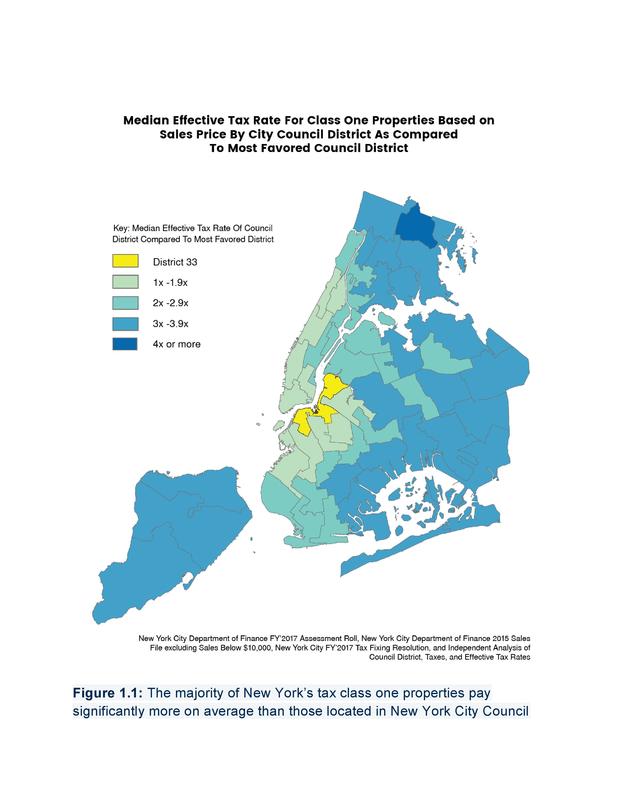

Your property tax rate is based on your tax class.

662 k street crescent city ca. There are four tax classes. New york collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The department of finance dof administers business income and excise taxes.

Nys taxable income less than 65000. Learn how to calculate your annual property tax. The median property tax in new york is 375500 per year for a home worth the median value of 30600000.

Nyc is a trademark and service mark of the city of new york. New yorks maximum marginal income tax rate is the 1st highest in the united states ranking directly below new yorks. You can take a refundable credit of 125 if youre married and filing a joint return and you have income of 250000 or less.

While the federal income tax and the new york income tax are progressive income taxes with multiple tax brackets all local income taxes are flat rate. The city income tax rates vary from year to year. New york ny sales tax rates by city.

Married and filing a joint nys return and one spouse was a full year new york city resident and the other was a nonresident for. Fourteen states including new york allow local governments to collect an income tax. Nys taxable income 65000 or more.

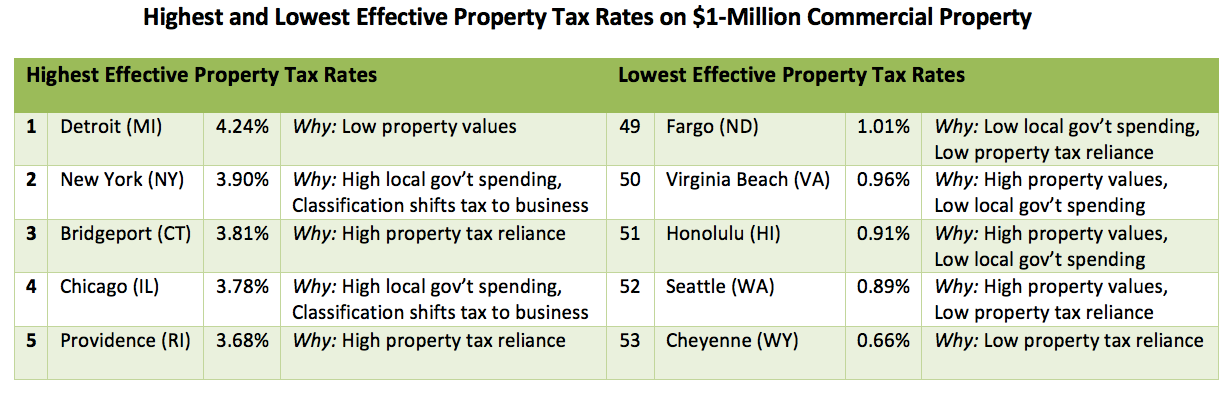

New york tobacco tax. New york has one of the highest average property tax rates in the country with only three states levying higher property taxes. Select the new york city from the list of popular cities below to see its current sales tax rate.

New york has recent rate changes sun sep 01 2019. On the other hand many products face higher rates or additional charges. Cigarettes are subject to an excise tax of 435 per pack of 20 and other tobacco products have a tax equaling 75 of the wholesale price.

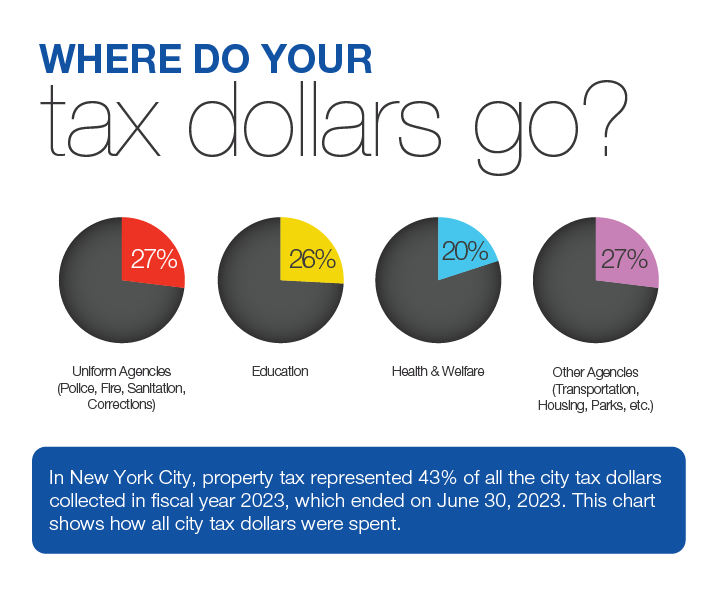

Dof also assesses the value of all new york city properties collects property taxes and other property related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property related charges through annual lien sales. In new york city there is an additional 150 excise tax per pack of cigarettes. The tax rates are listed below.

Nyc tax rate schedule. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. New york city resident tax.

The new york city school tax credit is available to new york city residents or part year residents who cant be claimed as a dependent on another taxpayers federal income tax return. New york property tax. New york city income tax.

Like the federal income tax new yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Class 1 21045. Use the nys tax computation.

What is a local income tax. New york city has a separate city income tax that residents must pay in addition to the state income tax. The state sales tax rate in new york is 4000.

Property tax rates for tax year 2021. Part year nyc resident tax.

Floridadude297 On Twitter If You Made 100 000 As A Resident Of New York City Your Take Home Pay Would Be 71 000 Making Your Total Income Tax Rate 29 You Haven T Paid Sales 662 K Street Crescent City Ca

More From 662 K Street Crescent City Ca

- New York City Library Lions

- 4 New City Street Essex Ct

- New York City Koreatown Food

- Jersey City Voting Guide

- Jersey City Tattoo Artists

Incoming Search Terms:

- Timing New York City Real Property Tax Rate Trend Jersey City Tattoo Artists,

- State Tax And Estate Planning Update Family And Matrimonial United States Jersey City Tattoo Artists,

- What New York Has Gained From Tax Cuts Empire Center For Public Policy Jersey City Tattoo Artists,

- 1 Jersey City Tattoo Artists,

- Https Www Jstor Org Stable 3487318 Jersey City Tattoo Artists,

- Income Tax Hike Looming For Ny Empire Center For Public Policy Jersey City Tattoo Artists,

.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/127810433-F-56a9384f3df78cf772a4e1fa.jpg)