Jersey City Property Tax Calculator

Find, Read, And Discover Jersey City Property Tax Calculator, Such Us:

- Jersey City Civic Committee Home Facebook Jersey City Property Tax Calculator,

- 1 Jersey City Property Tax Calculator,

- Property Tax Definition Uses And How To Calculate Thestreet Jersey City Property Tax Calculator,

- Guide To Pa Property Taxes Psecu Jersey City Property Tax Calculator,

- City Of Bayonne Nj Official Website Finance Division Jersey City Property Tax Calculator,

Jersey City Property Tax Calculator, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

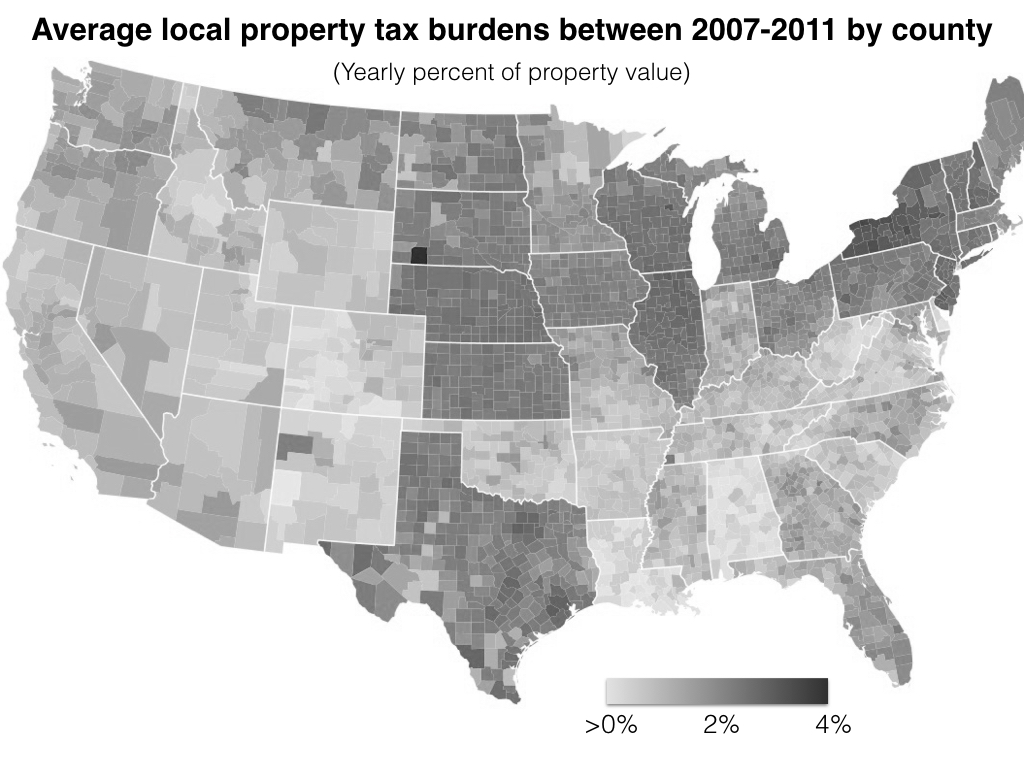

In bergen and essex counties west of new york city the average annual property tax bill is over 10000.

New york city lockdown end. City of jersey city montgomery st. By mail current taxes only addressed to city of jersey city po. Property tax due dates.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in hudson county. City of jersey city po. In nearly half of new jerseys counties real estate taxes for the average homeowner are higher than 8000 annually.

Dont let the high property taxes scare you away from buying a home in new jersey. How 2020 sales taxes are calculated in jersey. New jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Pay property taxes online in person the tax collectors office is open 830 am. The exact property tax levied depends on the county in new jersey the property is located in. 240 11604 00001 hancok s reit jcity corp 10 exchange pl.

The average effective property tax rate in new jersey is 244 compared with a national average of 108. The median property tax on a 38390000 house is 725571 in new jersey the median property tax on a 38390000 house is 403095 in the united states remember. Our new jersey property tax calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in new jersey and across the entire united states.

Property tax averages from this county will then be used to determine your estimated property tax. The average effective property tax rate in new jersey is 240 which is significantly higher than the national average of 119. The median property tax in new jersey is 657900 per year for a home worth the median value of 34830000.

New jersey is ranked 1st of the 50 states for property taxes as a percentage of median income. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 596 14503 00001 colgate ctrpropowners asc.

Each business day by mail check or money order to. In person at city hall 280 grove street room 102 by cash certified check money order or cashiers check. Starting with tax.

As mentioned above property taxes are usually tax deductible on your new jersey income tax return. Cds 57 essex st. View 14 photos of this 2 bed 2 bath 900 sq.

Counties in new jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. When combined with relatively high statewide property values the average property tax payment in new jersey is over 7800.

More From New York City Lockdown End

- New York City View

- The House At The End Of The Street Poster

- New York City Housing Authority Application

- City Street View Png

- Jersey City Nj Restaurants

Incoming Search Terms:

- Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders Jersey City Nj Restaurants,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctwsxd53qbm Dnbhhr8uab0zvtuwnujov0u5jgrwn15e0tlojav Usqp Cau Jersey City Nj Restaurants,

- Tax Collector S Office City Of Englewood Nj Jersey City Nj Restaurants,

- Property Tax Definition Uses And How To Calculate Thestreet Jersey City Nj Restaurants,

- State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities Jersey City Nj Restaurants,

- Tax Finance Dept Sparta Township New Jersey Jersey City Nj Restaurants,